Thinking about buying a house? The sticker price is just the beginning. Owning a home is a significant financial commitment, extending far beyond the initial purchase. Understanding the true “cost to reside in a house” requires a deep dive into fixed expenses like mortgage payments and property taxes, as well as variable costs such as utilities and repairs. This comprehensive guide breaks down every aspect, empowering you to make informed decisions and budget effectively for your dream home.

From analyzing fixed costs like property taxes and insurance to understanding the variability of utility bills and maintenance expenses, we’ll equip you with the knowledge to accurately estimate your total annual housing costs. We’ll also explore how factors like location, property size, and age impact your bottom line, helping you compare different housing types and make smart financial choices. Ultimately, this guide aims to demystify the true cost of homeownership, providing you with the tools to confidently navigate this significant financial undertaking.

Defining “Cost to Reside in a House”

The phrase “cost to reside in a house” encompasses far more than just the initial purchase price. It represents the total financial burden associated with owning and maintaining a property over time. Understanding this complete picture is crucial for responsible homeownership and sound financial planning. Failing to account for all these costs can lead to significant financial strain and even foreclosure.

Many people mistakenly equate the cost of residing in a house with its purchase price. However, the reality is significantly more complex. The purchase price is merely the starting point, a one-time expense in a much larger, ongoing financial commitment. The true cost of homeownership includes a wide array of recurring and unexpected expenses that can easily outweigh the initial investment over the years.

Components of the Total Cost of Residing in a House

The total cost of residing in a house is composed of several key components. These costs can be categorized broadly into fixed and variable expenses, and accurately estimating them is vital to budgeting effectively.

- Mortgage Payments: This is typically the largest recurring expense, encompassing principal and interest payments. The exact amount depends on factors like loan amount, interest rate, and loan term. For example, a $300,000 mortgage at a 6% interest rate over 30 years will result in significantly higher monthly payments than a $200,000 mortgage at the same interest rate and term.

- Property Taxes: These are levied annually by local governments and vary widely depending on location and property value. In some high-tax areas, property taxes can represent a substantial portion of the overall cost of homeownership. For instance, a high-value property in a state with high property taxes might incur annual taxes exceeding $10,000.

- Homeowners Insurance: This protects your property against damage from events like fire, theft, or natural disasters. Premiums are influenced by factors such as location, property value, and coverage levels. A home in a hurricane-prone area will naturally command higher insurance premiums than a similar property in a low-risk zone.

- Utilities: These include electricity, water, gas, and internet/cable services. The cost of utilities can fluctuate seasonally and varies based on household size and energy consumption habits. A larger family living in a colder climate will likely have significantly higher utility bills compared to a smaller household in a warmer climate.

- Maintenance and Repairs: Unexpected repairs and routine maintenance are inevitable. These costs can range from minor fixes to major renovations, significantly impacting your budget. A leaky roof, a malfunctioning appliance, or the need for a new HVAC system can easily lead to thousands of dollars in unexpected expenses.

- Homeowners Association (HOA) Fees (if applicable): Many communities have HOAs that collect fees to cover maintenance of common areas, amenities, and enforcement of community rules. These fees can vary significantly depending on the amenities offered and the size of the community.

The true cost of homeownership is the sum of all these expenses, not just the purchase price. Accurate budgeting and financial planning are essential to avoid financial hardship.

Fixed Costs of Homeownership

Understanding the fixed costs associated with owning a home is crucial for responsible budgeting and financial planning. These are expenses that remain relatively consistent month to month, regardless of your usage. Failing to account for these can lead to significant financial strain and jeopardize your long-term financial health. Let’s break down these predictable expenses to help you build a realistic budget.

Fixed Cost Categories

Fixed costs of homeownership can be broadly categorized into housing-related payments, property taxes, and insurance premiums. These represent the core financial obligations of homeownership, impacting your budget consistently. While some minor variations might occur, these costs form the bedrock of your monthly housing expenses.

| Cost Type | Description | Average Monthly Cost | Potential Factors Affecting Cost |

|---|---|---|---|

| Mortgage Payment | Principal and interest payment on your home loan. | $1,500 – $3,000 (Highly variable based on loan amount, interest rate, and loan term) | Loan amount, interest rate, loan term, property value |

| Property Taxes | Annual taxes levied by local governments on your property’s assessed value. | $200 – $500 (Highly variable based on property value and location) | Property value, local tax rates, property tax assessment |

| Homeowners Insurance | Protects your home and belongings from damage or loss. | $100 – $300 (Highly variable based on coverage, location, and risk factors) | Coverage amount, location, risk factors (e.g., age of home, proximity to fire hydrants), insurance company |

| Homeowners Association (HOA) Fees (if applicable) | Monthly fees paid to a homeowner’s association for maintenance of common areas. | $50 – $500+ (Highly variable based on community amenities and services) | Community amenities, size of the HOA, maintenance needs |

| Private Mortgage Insurance (PMI) (if applicable) | Insurance required if your down payment is less than 20% of the home’s purchase price. | $50 – $200+ (Varies based on loan amount and credit score) | Loan-to-value ratio (LTV), credit score |

Visual Representation of Fixed Costs

Imagine a pie chart representing the total monthly fixed costs of homeownership. The largest slice would likely be the mortgage payment, potentially occupying 40-60% of the chart, depending on the individual’s loan terms and property value. Property taxes would represent a significant portion as well, perhaps 15-25%, reflecting the regional variations in tax rates. Homeowners insurance would comprise a smaller but still substantial slice, around 10-15%, varying with coverage levels and location-specific risk factors. HOA fees, if applicable, would occupy a smaller slice, potentially 5-15%, depending on the community and its amenities. Finally, PMI, if applicable, would be a smaller slice, reflecting the percentage of the loan amount and credit score. The precise proportions would vary significantly based on individual circumstances, but this provides a general visualization of the relative importance of each cost. For example, a homeowner with a large mortgage in a high-tax area would see a much larger proportion dedicated to mortgage and property taxes than a homeowner with a smaller mortgage and lower property taxes in a different area. This highlights the critical need for personalized budgeting based on individual circumstances.

Variable Costs of Homeownership

Unlike fixed costs, which remain relatively constant, variable costs fluctuate based on your usage and external factors. Understanding and budgeting for these unpredictable expenses is crucial for responsible homeownership. Failing to account for these variations can lead to unexpected financial strain and potentially jeopardize your financial stability. Let’s delve into the specifics.

Variable homeownership costs represent a significant portion of your overall housing expenses. Accurately predicting these costs requires careful consideration of your lifestyle, geographic location, and prevailing market conditions. The more accurately you can estimate these expenses, the better prepared you’ll be to handle them without disrupting your financial well-being.

Utilities

Utilities are a major source of variable costs. These expenses are directly tied to your consumption and are influenced by seasonal changes and energy prices. Failing to budget appropriately for these fluctuations can result in significant financial surprises.

- Electricity: Costs vary based on usage (heating, cooling, appliances) and electricity rates. A hot summer will drastically increase your bill compared to a mild one.

- Gas: Similar to electricity, gas usage fluctuates with heating needs and cooking habits. A particularly cold winter can lead to substantially higher bills.

- Water: Water bills are influenced by usage (showers, laundry, gardening) and water rates set by your local municipality. Leaks can dramatically increase costs.

- Trash and Recycling: These fees vary depending on your local municipality’s pricing structure and the amount of waste generated.

- Internet and Cable: While often considered a separate expense, these services are essential for many homeowners and their costs can change with different plans and providers.

Home Maintenance and Repairs

Unexpected repairs and maintenance are a significant source of variable costs. These expenses can range from minor fixes to major renovations, depending on the age and condition of your home. Regular maintenance can mitigate some of these costs, but unforeseen issues will always arise.

- Appliance Repairs: Washing machines, dryers, refrigerators, and other appliances can break down unexpectedly, leading to costly repairs or replacements.

- Plumbing Issues: Leaky pipes, clogged drains, and other plumbing problems can quickly become expensive.

- Roof Repairs: Roof damage from storms or age-related wear can require substantial repairs or replacement.

- Pest Control: Regular pest control is essential, but unexpected infestations can lead to additional costs.

Property Taxes

While property taxes are often considered a fixed cost, they can experience variability. Reassessments based on property value changes can lead to fluctuations in your annual tax bill. Changes in local government tax rates can also impact your property taxes.

For example, a reassessment that increases your home’s value will directly result in higher property taxes. Conversely, a decrease in your home’s assessed value might lead to lower property taxes.

Homeowners Insurance

Homeowners insurance premiums are variable and depend on several factors, including your coverage level, location, and claims history. A significant weather event in your area could increase your premiums in subsequent years.

For instance, if you live in a hurricane-prone region, your premiums will be higher than someone in a less-risky area. Filing a claim, even for a minor incident, can impact your future premiums.

Factors Influencing Housing Costs

Understanding the true cost of homeownership goes beyond the mortgage payment. Numerous interconnected factors significantly impact the overall expense, influencing everything from your initial investment to ongoing maintenance. Ignoring these variables can lead to significant financial surprises down the line, so a thorough understanding is crucial before taking the plunge.

Geographic Location’s Impact on Housing Costs

Location, location, location – the real estate mantra holds true. Housing costs vary dramatically based on geographic location, driven by factors like supply and demand, local economic conditions, and proximity to amenities. Coastal areas, major metropolitan centers, and regions with desirable climates typically command significantly higher prices due to increased competition and limited land availability. For example, a comparable house in Manhattan, New York, will cost exponentially more than a similar property in a rural area of Nebraska. This difference reflects not only the land value but also the cost of construction, labor, and taxes in each region. Tax rates, property insurance premiums, and even the cost of utilities often correlate with location, further influencing the total cost of residence.

Categorization of Factors Influencing Housing Costs

The factors influencing housing costs can be broadly categorized into economic, geographic, and property-specific elements. These categories are intertwined and often influence each other. For instance, a property’s size (property-specific) will naturally impact its cost, but the prevailing economic climate (economic) and the location (geographic) will also play significant roles in determining the final price.

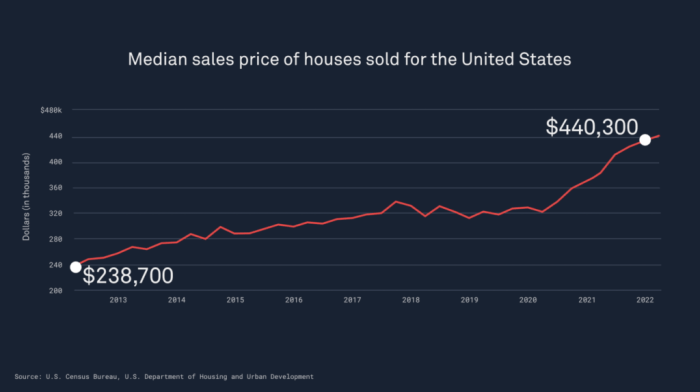

Economic Factors Influencing Housing Costs

Economic factors play a critical role in shaping housing costs. Interest rates, inflation, and overall economic growth significantly influence mortgage rates and the affordability of homes. During periods of low interest rates, borrowing becomes cheaper, potentially driving up demand and prices. Conversely, high inflation can erode purchasing power, making it harder for individuals to afford homes. Government policies, such as tax incentives for homebuyers or regulations impacting the construction industry, can also have a considerable impact on housing costs. For instance, a tax credit aimed at first-time homebuyers could temporarily increase demand and potentially prices.

Geographic Factors Influencing Housing Costs

Geographic factors are crucial determinants of housing costs. These include proximity to employment centers, schools, and amenities, as well as the overall desirability of a neighborhood or region. Areas with excellent schools, low crime rates, and convenient access to transportation and shopping typically command higher prices. Natural features like proximity to water, mountains, or parks also often contribute to increased housing costs. Furthermore, climate plays a role; warmer climates with favorable weather conditions often attract higher demand, leading to increased prices.

Property-Specific Factors Influencing Housing Costs

Property-specific factors directly relate to the characteristics of the house itself. The size of the house, the number of bedrooms and bathrooms, the lot size, and the overall condition of the property significantly impact its value and cost. A larger house with more amenities will generally be more expensive than a smaller, more basic property. The age of the house is also a significant factor; older homes may require more maintenance and repairs, potentially increasing the overall cost of ownership. The materials used in construction, the architectural style, and the presence of unique features also contribute to the property’s value and cost. A newly constructed home with modern amenities and high-quality materials will usually command a higher price than an older home in need of significant renovations.

Property Size and Age’s Influence on Cost

Property size and age are intrinsically linked to overall housing costs. Larger properties, offering more living space and potentially more land, naturally demand higher prices. This is a simple function of supply and demand; larger homes are generally less abundant. The age of a property significantly impacts maintenance and repair costs. Older homes, while often possessing charm and character, may require more frequent and expensive repairs and renovations, adding to the overall cost of ownership. For example, a 100-year-old Victorian home might require significant upgrades to its plumbing, electrical systems, and foundation, significantly increasing its overall cost compared to a newly built contemporary home.

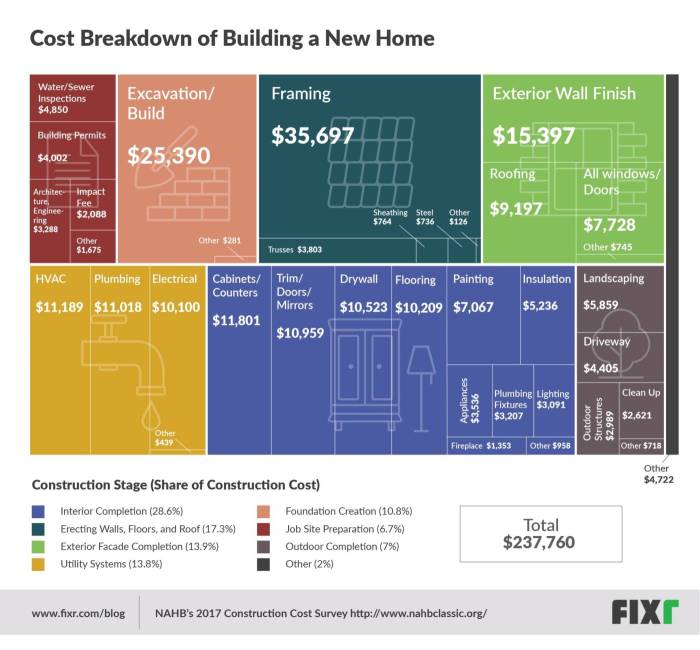

Estimating Total Housing Costs

Accurately estimating your total annual housing costs is crucial for sound financial planning. Understanding these costs allows you to budget effectively, avoid financial surprises, and make informed decisions about homeownership. Ignoring even seemingly small expenses can lead to significant budget shortfalls over time. Let’s break down a methodical approach to calculating these costs.

Calculating your total annual housing cost involves summing all fixed and variable expenses associated with owning a home. This goes beyond just your mortgage payment; it encompasses a holistic view of your financial commitment. By understanding both predictable and fluctuating costs, you can create a realistic budget and avoid unexpected financial strain.

A Method for Calculating Total Annual Housing Costs

To accurately determine your total annual housing cost, follow these steps. First, meticulously list all your fixed costs, such as mortgage payments (principal and interest), property taxes, and homeowner’s insurance. Then, identify your variable costs, which include utilities (electricity, gas, water, trash), maintenance and repairs, landscaping, and potential HOA fees. Finally, sum these costs to arrive at your total annual housing expense. Remember to account for potential increases in costs over time, such as inflation.

Examples of Different Cost Scenarios

Let’s consider three scenarios to illustrate the variability in housing costs:

Scenario 1: Budget-Conscious Homeowner

Assume a modest home with a $1,500 monthly mortgage, $200 monthly property taxes, $100 monthly homeowner’s insurance, and average monthly utility bills of $300. Annual maintenance is estimated at $500. Total annual cost: ($1,500 + $200 + $100 + $300) * 12 + $500 = $26,900.

Scenario 2: Mid-Range Homeowner

Consider a larger home with a $2,500 monthly mortgage, $300 monthly property taxes, $150 monthly homeowner’s insurance, and average monthly utilities of $400. Annual maintenance and repairs are estimated at $1,000, and HOA fees are $100 per month. Total annual cost: ($2,500 + $300 + $150 + $400 + $100) * 12 + $1,000 = $46,600.

Scenario 3: Luxury Homeowner

Imagine a high-end property with a $5,000 monthly mortgage, $500 monthly property taxes, $250 monthly homeowner’s insurance, and average monthly utilities of $600. Annual maintenance and repairs are estimated at $2,000, and HOA fees are $300 per month. Total annual cost: ($5,000 + $500 + $250 + $600 + $300) * 12 + $2,000 = $86,600.

Step-by-Step Guide for Estimating Future Housing Costs

Predicting future housing costs requires considering inflation and potential property value changes.

Step 1: Project Inflation

Use historical inflation data or projected inflation rates to estimate future increases in expenses like property taxes, insurance, and utilities. For example, if inflation is projected at 3% annually, a $300 utility bill could increase to approximately $309 in one year ($300 * 1.03).

Step 2: Assess Property Value Changes

Research local real estate trends to estimate potential changes in your property’s value. This impacts property taxes, which are typically based on assessed value. If your property value increases, expect higher property taxes in the future.

Step 3: Factor in Maintenance and Repair Needs

Create a realistic budget for maintenance and repairs. Older homes generally require more significant investments than newer ones. Consider setting aside a contingency fund for unexpected repairs.

Step 4: Calculate Projected Annual Costs

Apply the projected inflation rates and property value changes to your current annual housing costs. This provides a more accurate estimate of your future housing expenses.

To accurately predict future housing costs, use a conservative estimate for inflation and factor in unexpected expenses. A contingency fund is essential.

Comparing Housing Costs Across Different Housing Types

Choosing the right type of housing is a significant financial decision. Understanding the cost differences between single-family homes, townhouses, and condominiums is crucial for making an informed choice that aligns with your budget and lifestyle. This section will break down the typical costs associated with each housing type, highlighting their respective advantages and disadvantages from a purely financial perspective.

Single-Family Home Costs

Single-family homes typically represent the highest upfront and ongoing costs. The initial purchase price is usually significantly higher than townhouses or condos, especially in desirable areas. Ongoing costs also tend to be greater, as you’re solely responsible for all maintenance and repairs, both inside and outside the property. This includes landscaping, roof repairs, foundation maintenance, and more. Consider this example: a 2,000 sq ft single-family home in a suburban area might cost $500,000 to purchase, with annual property taxes around $8,000 and potential annual maintenance exceeding $5,000. This doesn’t include mortgage payments, which can significantly add to the total cost of ownership. The advantage, however, lies in the greater privacy, space, and potential for appreciation.

Townhouse Costs

Townhouses offer a middle ground between single-family homes and condominiums. The purchase price is generally lower than a comparable single-family home, and you’ll share some maintenance responsibilities with a homeowners association (HOA). The HOA typically covers exterior maintenance, landscaping, and snow removal, reducing your individual burden. However, you’ll still be responsible for interior maintenance and repairs. For instance, a 1,500 sq ft townhouse might cost $350,000, with annual HOA fees around $3,000 and annual property taxes around $6,000. The lower initial cost and reduced maintenance responsibilities make townhouses an attractive option for many buyers. The trade-off is less privacy and potentially less space than a single-family home.

Condominium Costs

Condominiums generally have the lowest initial purchase price and ongoing costs. The HOA typically covers a significant portion of maintenance, including exterior repairs, landscaping, and building insurance. This reduces your individual financial responsibility considerably. However, you’ll have less control over the property’s appearance and might face restrictions on renovations. A 1,000 sq ft condo could cost $250,000, with annual HOA fees around $2,500 and annual property taxes around $4,000. The lower costs make condos ideal for first-time homebuyers or those seeking a more manageable lifestyle. The downside is less space, less privacy, and potential limitations on customization.

Cost Comparison Table

To further illustrate the cost differences, consider this simplified comparison table based on hypothetical examples:

| Housing Type | Purchase Price (Estimate) | Annual Property Taxes (Estimate) | Annual HOA/Maintenance (Estimate) |

|---|---|---|---|

| Single-Family Home | $500,000 | $8,000 | $5,000 |

| Townhouse | $350,000 | $6,000 | $3,000 |

| Condominium | $250,000 | $4,000 | $2,500 |

Remember that these are estimates, and actual costs will vary significantly based on location, size, condition, and amenities. Always conduct thorough research and consult with professionals before making a housing decision.

Managing Housing Costs

Owning a home is a significant financial commitment, and effectively managing housing costs is crucial for long-term financial health. Understanding the various strategies for cost reduction, the impact of energy efficiency, and the available financial tools are key components of responsible homeownership. This section will delve into practical approaches to keep your housing expenses under control and optimize your budget.

Reducing housing costs requires a multifaceted approach encompassing both proactive measures and strategic financial planning. Many homeowners find that a combination of techniques yields the most effective results, allowing them to significantly lower their monthly outlays and improve their overall financial well-being.

Strategies for Reducing Housing Costs

Lowering your housing costs often involves a blend of short-term and long-term strategies. Some approaches offer immediate savings, while others require more time and investment but provide substantial long-term benefits. A comprehensive strategy usually includes a mix of both.

Effective cost reduction strategies include exploring refinancing options to secure a lower interest rate on your mortgage, negotiating lower property taxes with your local assessor’s office, reducing your energy consumption through energy-efficient upgrades, and carefully managing your home maintenance to prevent costly repairs. Additionally, proactively searching for ways to reduce your insurance premiums can significantly impact your overall housing costs.

Impact of Energy Efficiency on Overall Costs

Energy efficiency improvements significantly impact overall housing costs, resulting in substantial long-term savings. By reducing energy consumption, homeowners can lower their utility bills, a considerable portion of their monthly housing expenses. This translates to more disposable income and improved financial stability.

Investing in energy-efficient appliances, upgrading insulation, and installing energy-efficient windows are examples of home improvements that lead to considerable long-term savings. For instance, replacing old appliances with Energy Star-rated models can reduce energy consumption by up to 50%, leading to a significant decrease in electricity bills. Similarly, improving insulation can reduce heating and cooling costs by up to 30%, depending on the climate and the extent of the improvements.

Financial Tools and Resources for Managing Homeownership Expenses

Several financial tools and resources can assist homeowners in effectively managing their expenses. These tools provide insights into spending habits, allow for better budgeting, and offer options for debt management. Utilizing these resources empowers homeowners to make informed decisions and maintain financial stability.

Budgeting apps and software, such as Mint or YNAB (You Need A Budget), help track income and expenses, allowing homeowners to identify areas where they can cut back. Online mortgage calculators can assist in comparing different refinancing options, helping homeowners find the best interest rates and terms. Finally, credit counseling agencies can provide guidance on debt management strategies, helping homeowners create a plan to pay down their mortgage and other debts more efficiently.

Owning a home is a significant investment, but with careful planning and a thorough understanding of all associated costs, it can be a rewarding experience. By meticulously analyzing both fixed and variable expenses, and considering factors like location and property type, you can accurately estimate your total housing costs. Remember to factor in potential future increases and utilize financial tools to manage expenses effectively. Armed with this knowledge, you can confidently navigate the complexities of homeownership and make smart, informed decisions that align with your financial goals.

Top FAQs

What are closing costs, and how much should I expect to pay?

Closing costs are fees paid at the end of a real estate transaction. They vary widely but typically range from 2% to 5% of the home’s purchase price and cover items like loan origination fees, appraisal costs, title insurance, and recording fees.

How can I reduce my property taxes?

Explore available tax exemptions and deductions offered by your local government. Accurate property valuation is crucial; appeal assessments if you believe your property is overvalued.

What are homeowner’s insurance premiums based on?

Premiums are determined by several factors, including your home’s location, age, construction, coverage amount, and your claims history. A good credit score can also lower your premiums.

How often should I budget for major home repairs?

Plan for annual maintenance costs, and create a separate savings account for larger, unexpected repairs. A good rule of thumb is to budget 1-4% of your home’s value annually for repairs and maintenance.

What’s the difference between a condo fee and HOA dues?

Condo fees cover building maintenance and amenities specific to your condo unit, while HOA dues cover shared amenities and maintenance within a larger community.